📈 Want to try us out?

We’re excited to offer something new:

You can now try our trading strategies — for just $9! 💸

This offer gives you access to our tested and systematic trading strategies. It’s a low-cost way to explore what we do and see if it fits your trading style. 📈

Here’s what you get:

✅ Immediate access to 2 strategies of your choice

✅ No long-term commitment

✅ Just $9 to start

✅ Cancel yourself whenever you want

Whether you're a short-term trader or a long-term investor, this is a simple way to test ideas and improve your edge. ⚙️📊

Happy trading,

Oddmund & Sammy ✨

🔍 Jim Simons vs. Warren Buffett: Who Is the Greatest Investor?

Who is the best investor: Jim Simons or Warren Buffett? Jim Simons died in 2024, and Buffett retires at the end of 2025, aged 95.

Thus, it might be relevant to ask: Jim Simons vs. Warren Buffett: Who is the greatest investor of all time?

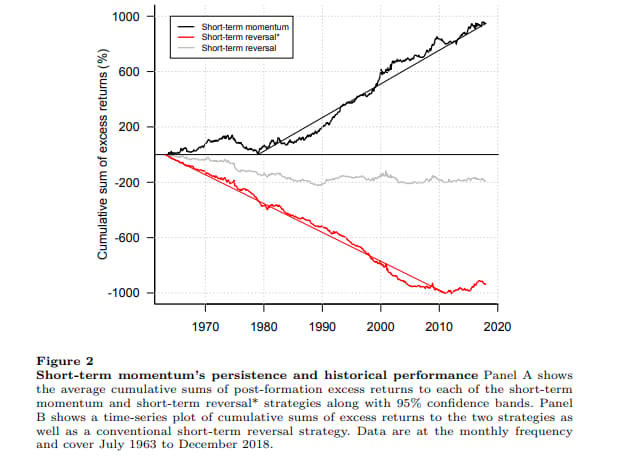

🔍 Short-Term Momentum Strategy (16.4% Per Year)

A strategy that buys last month’s winners and shorts its losers within this high-turnover group generates a positive and significant average return of 16.4% per annum! This is the essence of short-term momentum.

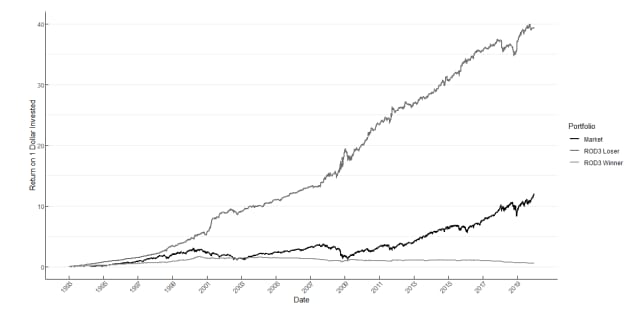

🔍 End of Day Reversal Trading Strategy (Day Trading)

Why do intraday losers pop in the final 30 minutes of the trading session? This article presents the abnormal returns obtained from buying intraday losers and explores potential reasons for this anomaly.

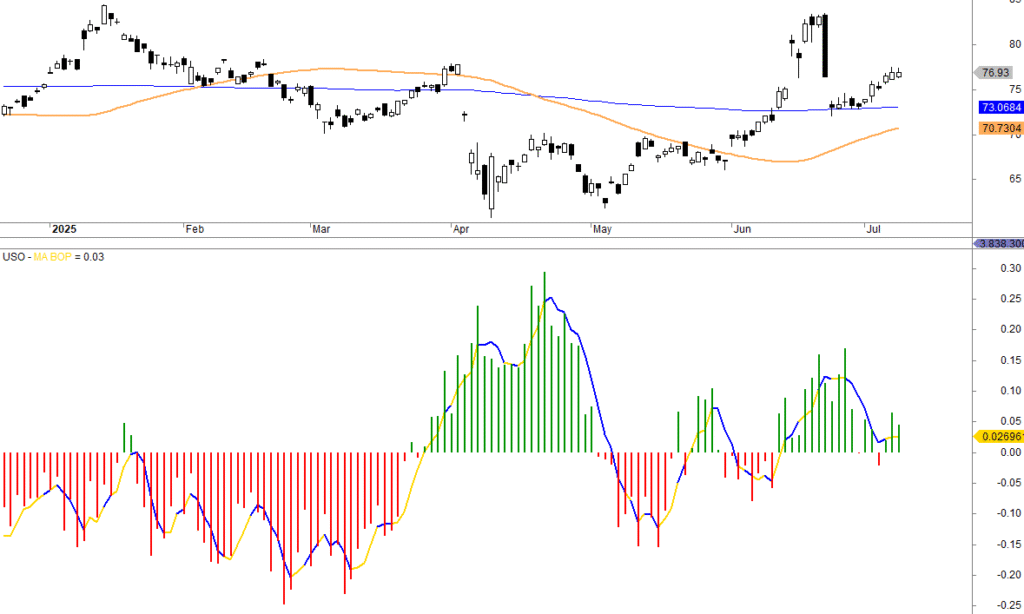

🔍 Balance of Power (BOP) – Statistics, Facts And Historical Backtests

The Balance of Power (BOP) indicator is a momentum oscillator that evaluates the strength of buying and selling pressure in the market. It oscillates around the zero line, with positive values indicating buying pressure and negative values indicating selling pressure. The indicator compares a price bar’s body to its range and, thus, gauges the power of buyers to push prices higher and sellers to move prices lower.

We backtested it:

🔍 Bogleheads 3 and 4 Fund Portfolio

Jack Bogle’s famous advice was to avoid searching for individual stocks, sectors, or markets that may perform better and simply invest in the entire market. This means using index funds to build a diversified portfolio. The Bogleheads 3 Fund Portfolio (global stocks, U.S. bonds) and Bogleheads 4 Fund Portfolio (global stocks, global bonds) are good examples of the approach. Let’s find out what they are about.

🔍 Lumber/Gold Ratio Trading Strategy For Stocks And Bonds

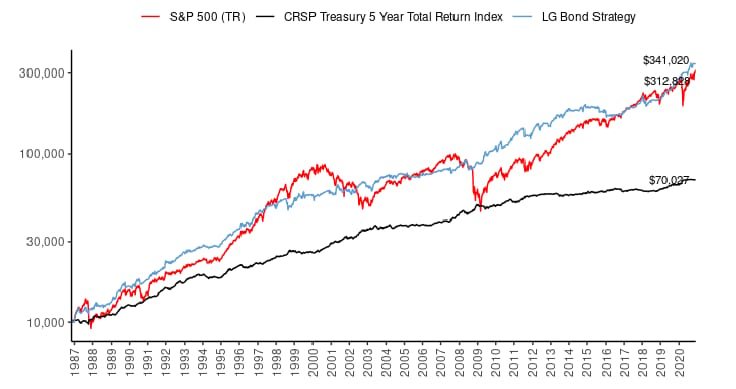

In May 2015, Micheal A. Gayed published a paper called Lumber: Worth Its Weight in Gold Offense and Defense in Active Portfolio Management (free download at SSRN). We used that paper to make a profitable lumber/gold ratio trading strategy for stocks and bonds.

📈 Want to try us out?

We’re excited to offer something new:

You can now try our trading strategies — for just $9! 💸

This offer gives you access to our tested and systematic trading strategies. It’s a low-cost way to explore what we do and see if it fits your trading style. 📈

Here’s what you get:

✅ Immediate access to 2 strategies of your choice

✅ No long-term commitment

✅ Just $9 to start

✅ Cancel yourself whenever you want

Whether you're a short-term trader or a long-term investor, this is a simple way to test ideas and improve your edge. ⚙️📊

Happy trading,

Oddmund & Sammy ✨