sia

Statistics don’t care about opinions.

Santa Claus Rally?

The Santa Claus rally is no myth or fiction. The stock market shows significantly better performance during Christmas and the days leading up to the New Year.

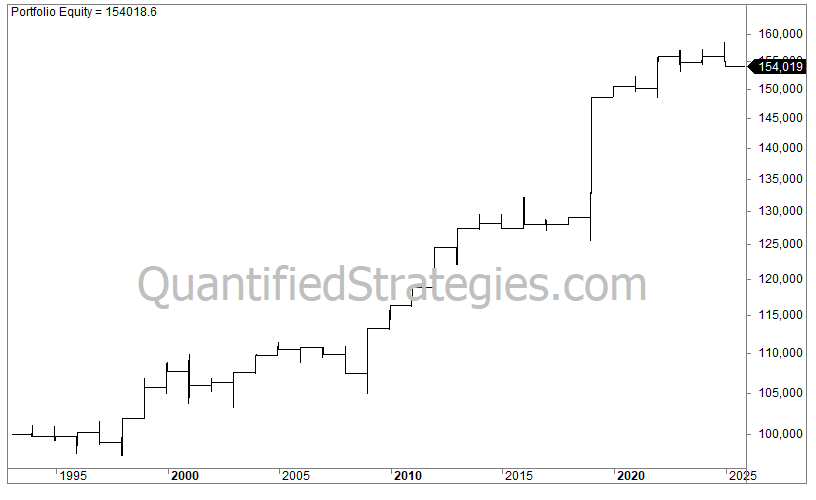

Santa Rally In Gold And Miners

The Santa Rally has been more consistent for gold and miners than for stocks:

Williams %R Strategy

What about a strategy that has an 11.5% annual return while being invested just a fraction of the time?

Backtest of the Week

The Christmas period is historically a good period for both stocks and gold.

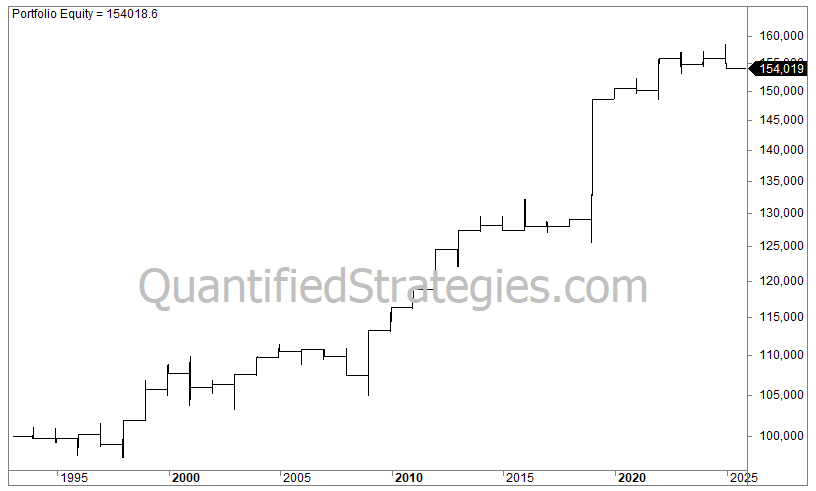

If we buy the close on the third Friday of December and sell at the close of the first trading day of the new year, we get the following equity curves for the S&P 500 (SPY):

📊 Results:

🔢 #trades: 32

📈 Avg gain per trade: 1.4%

📊 CAGR (annual returns): 1.3%

✅ Win Rate: 72%

⏱️ Exposure: 3.3%

⚠️ Max Drawdown: -6%

Gold (GLD):

📊 Results:

🔢 #trades: 21

📈 Avg gain per trade: 2.1%

📊 CAGR (annual returns): 2.1%

✅ Win Rate: 90%

⏱️ Exposure: 3.3%

⚠️ Max Drawdown: -5%

Oil vs Gold Hits Extreme Lows — Rare Signal Setup

Leading Indicators: Predicting the Next Shift in the Economy

A Reliable Signal for Market Corrections?

A Structural Edge Hidden in Peer Networks

Drawdowns Are Common — Recovery Is the Norm

Unusual SPY Volume Has Historically Signaled a Bounce

😵 Behavioral Bias of the Week

Anchoring bias

Anchoring bias in trading often leads to the Martingale bias: to lower the cost price, you use a double down trading strategy. Unfortunately, the market has no memory, so it won’t care about your cost price.

😵 Risk Reward Ratio

The risk-reward ratio is a key tool in investing that compares the potential profit to the potential loss of an investment, guiding investors in evaluating the attractiveness of a trade; ideal ratios are often cited as 1:3.

Strategy Bundles

Did you know that we offer strategy bundles? If you want to dip your toe in the water, this might be the perfect option.

PS: You can buy bundles for a substantial rebate before the 2nd of December (Black Friday sale) - please see the top of the email.

Here is the “beginner” bundle for S&P 500 (SPY), which contains 4 strategies (several years out of sample results):

📊 Results:

📈 Avg gain per trade: 0.7%

📊 CAGR (annual returns): 13%

✅ Win Rate: 74%

⏱️ Exposure: 27%

⚠️ Max Drawdown: -23%

🧠 Quote of the Week

We become what we consistently do.

Brett Steenbarger