Statistics don’t care about opinions.

Volume RSI Strategy

This is a modified version of the classical RSI indicator - incorporating volume.

Laguerre RSI (A Different RSI)

The Laguerre RSI is a lesser-known but highly effective momentum indicator developed by John Ehlers. It aims to improve on the traditional RSI by applying a Laguerre filter, which smooths price data while maintaining responsiveness to recent price changes.

Money Flow Index Strategy

The money flow index (MFI) is a momentum indicator that measures the flow of money into and out of a security over a specified period of time by combining price and volume data. We backtested it.

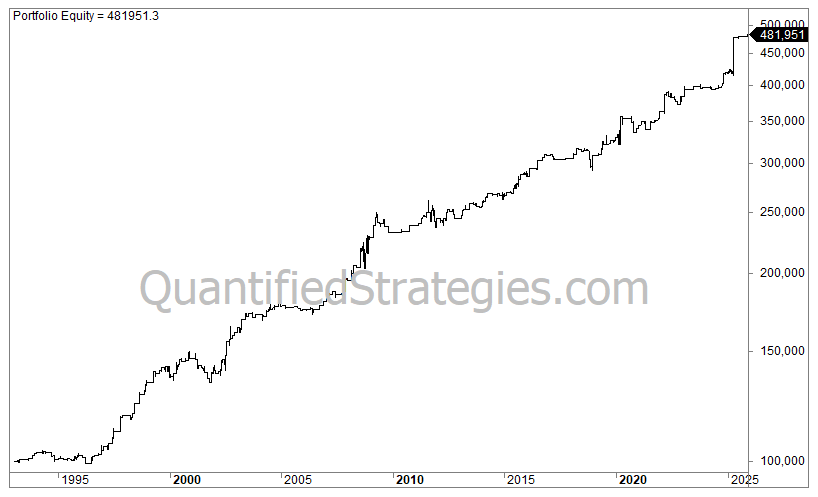

Backtest of the Week

Last Monday, the close was lower than Friday's low.

If we buy the close and sell after two trading days on such setups, we get the following equity curve for SPY/S&P 500:

📊 Results:

🔢 #trades: 346

📈 Avg gain per trade: 0.45%

📊 CAGR (annual returns): 5%

✅ Win Rate: 61%

⏱️ Exposure: 8.3%

⚠️ Max Drawdown: -10%

The 100% Signal: Fed Cuts Near All-Time Highs

Fed Surprises and Stock Market Returns: The Positive Link

The Midterm Drawdown Effect: A Look at the Data

AAII Bears Signal Easing Fear, Historical Win Rates High

😵 Behavioral Bias of the Week

Anchoring bias

Anchoring bias in trading often leads to the Martingale bias: to lower the cost price, you use a double down trading strategy. Unfortunately, the market has no memory, so it won’t care about your cost price.

😵 Risk Reward Ratio

The risk-reward ratio is a key tool in investing that compares the potential profit to the potential loss of an investment, guiding investors in evaluating the attractiveness of a trade; ideal ratios are often cited as 1:3.

Strategy Bundles

Did you know that we offer strategy bundles? If you want to dip your toe in the water, this might be the perfect option.

PS: You can buy bundles for a substantial rebate before the 2nd of December (Black Friday sale) - please see the top of the email.

Here is the “beginner” bundle for S&P 500 (SPY), which contains 4 strategies (several years out of sample results):

📊 Results:

📈 Avg gain per trade: 0.7%

📊 CAGR (annual returns): 13%

✅ Win Rate: 74%

⏱️ Exposure: 27%

⚠️ Max Drawdown: -23%

🧠 Quote of the Week

We become what we consistently do.

Brett Steenbarger